At 22 per cent statutory rate, the tax rate is lower than the global average.

With the Finance Minister Nirmala Sitharaman announcing a sharp cut in tax rates for corporates, India is now among the countries that have a low corporate tax rate. Though the incentive is only for companies that do not claim any exemption, it is a big move that brings India on par with peers in Asia and across the globe.

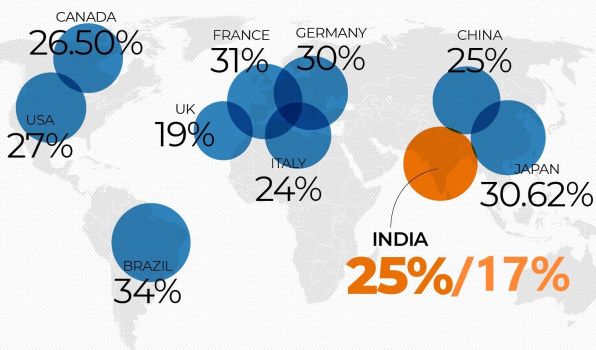

India’s statutory rate for corporate tax is 22 per cent now, down from 30 per cent.

The statutory tax rate in Myanmar is 25 per cent, in Malaysia, it is 24 per cent, in Indonesia and Korea 25 per cent and Sri Lanka 28 per cent. Even Chinese companies cough up more – they pay a tax of 25 per cent and Brazil 34 per cent. The global average corporate tax rate is 23.79 now, and the Asian average is 21.09 per cent.

Boost of manufacturing sector| Sharp decline in tax rate

Finance Minister Nirmala Sitharamanalso announced a sharp cut in tax rates for corporates engaged in manufacturing sector.

Manufacturing companies incorporated after 1 October 2019, will have the benefit of an even lower rate of 15 per cent (effective tax rate of 17.01 per cent). Also, companies not availing exemptions and tax incentives will not be required to pay minimum alternate tax (MAT).

The step to cut corporate tax for manufacturing company is historic. It will give a great stimulus to #makeInIndia, attract private investment from across the globe, and improve competitiveness of the private sector.